COMMODITIES TRADING

Trade a large number of precious metals, energy commodities

and agriculture through CFDs or on commodity exchanges.

Overview

Precious metals like Gold, Silver, Palladium have been used since old times as means of exchange. They are still very famous trading instruments. Furthermore Gold is considered as a safe haven because their state does not change too much related to other assets. Commodities offer a wide range of diversity. Commodities are linked with basic needs of human beings, this is why commodities are everywhere present, in any process of life. First, they were traded against each other- a bushel of grain for crude oil, a copper ingot for sugar and coffee. Nowadays, commodities are traded directly against the US dollar mainly, and other currencies also.

When you choose to diversify your trading portfolio with the safest class of financial instruments, with commodities, you better keep an eye on the news, weather and political events- which are the major influencers for commodity prices. Let’s see how. If OPEC members have disagreements and leave their meeting with disagreements, then oil price tends to have fluctuations depending on the type of disagreement. Heavy rains or long dry seasons cause agriculture price movements. Having a wide view of global economic issues, you will enjoy a better trading experience.

In contrast, commodities with other financial assets, commodities trade raw materials and primary goods and not certain products or services as the stock or forex market do. Commodities are divided into soft and hard types. Soft represent agriculture products and hard are usually mined like energies and precious metals.

Commodities, as mentioned before, are dependent on supply, demand production levels, politics, taxes, and weather conditions. Gold representing precious metals is one of the biggest commodity assets. Gold remains the number one precious metal because of the value storage and numerous industrial uses. Gold is called ‘safe-haven’ since it is a good risk neutralizer. Gold is always found in the trading portfolio of traders who want to protect their capital against market price movements.

There are three most crucial reasons which influence traders to choose commodities as investment assets. The population growth- population growth means more mouths to feed, which raise the demand for agricultural commodities. Also, people need infrastructure which could have a significant impact on the demand for metal and energy commodities. Inflation rate is the rate at which prices increase. So, with the same amount of money as today, tomorrow you will buy less products of the same type. Speaking of commodities, it will need more dollars to buy the same amount of a certain commodity in the future, which will lead to higher prices of the commodities. Portfolio diversification, if you diversify your portfolio in various commodities, the loss which might come from decreasing markets will be recovered by other assets which might be stable or even in a higher state. Commodities will help you to create diversification and better manage risk.

Know more

- What types of commodities can I trade?

You can trade commodities from all the categories.

- When should I buy, when should I sell?

If you think the price will go up, buy the asset now, and vice versa if you think it will go down.

- Are commodities high risk assets?

Higher risk comes with bigger rewards. In normal conditions, commodities are considered safe haven, meaning that compared to other assets they are safer.

- What is the most stable commodity?

Commonly found commodities like aluminum, zink, copper are perfect examples of stable commodities. The only advantage is that the price is lower compared to precious metals.

- What is the most volatile commodity?

According to numbers, the most volatile commodities are Gold and Silver. Zinc, Nickel, Copper come next.

- What are commodities?

Commodities are assets which come from the earth, which need to be mined or harvested. They include hard and soft commodities. Commodities are usually considered as safe haven because their prices do not fluctuate like other assets do.

- What are energy commodities?

The energy commodity category includes crude oil, gasoline, natural gas, heating oil. The intensity of commodity trading determines oil prices.

- What are agricultural commodities?

Agriculture commodities include soft ones like sugar, cocoa, coffee; grains like wheat, soybeans, soybean oil, rice, oats, and corn; livestock like live cattle and pork and things people do not eat like cotton and lumber.

- How does the commodity market work?

Commodity prices are determined by the volume they are trading. This way their prices change day by day. Especially energy prices like oil and gasoline change more often compared to other commodity categories. Commodities are mostly traded through future contracts. Pairs agree on a certain price and specific date. Contracts are priced in the US dollars, so when the value of the currency rises, fewer dollars are needed to buy the same amount of commodities. This will lead to commodity price fall.

- What determines oil price?

Current supply, future supply and demand are three main price determiners. Current supply is the total amount of oil available. 60% of the world’s reserves are supplied by OPEC. During pandemic time, while 40% of the population was told to stay at home, the demand dropped. OPEC and Russia did not cut the supply, they increased production to maintain market share. Prices dropped drastically. Future supplies represent what is available in the refineries reserves.

- What influences commodity prices?

Commodity prices are influenced by the supply and demand for the commodity, the weather conditions (mostly for agriculture), economic and political events, the value of the US dollar.

Live Prices

An exceptional customer service support

Negative Balance

Protection

Trade with the most specialized

trading technology in the market.

Segregated

Accounts

Client capital is kept in separate accounts. The company is not able to use your funds for any reason.

Extra Security for

Big Funding

Additional risk management tools and standards to protect your capital up to $ 1 Million.

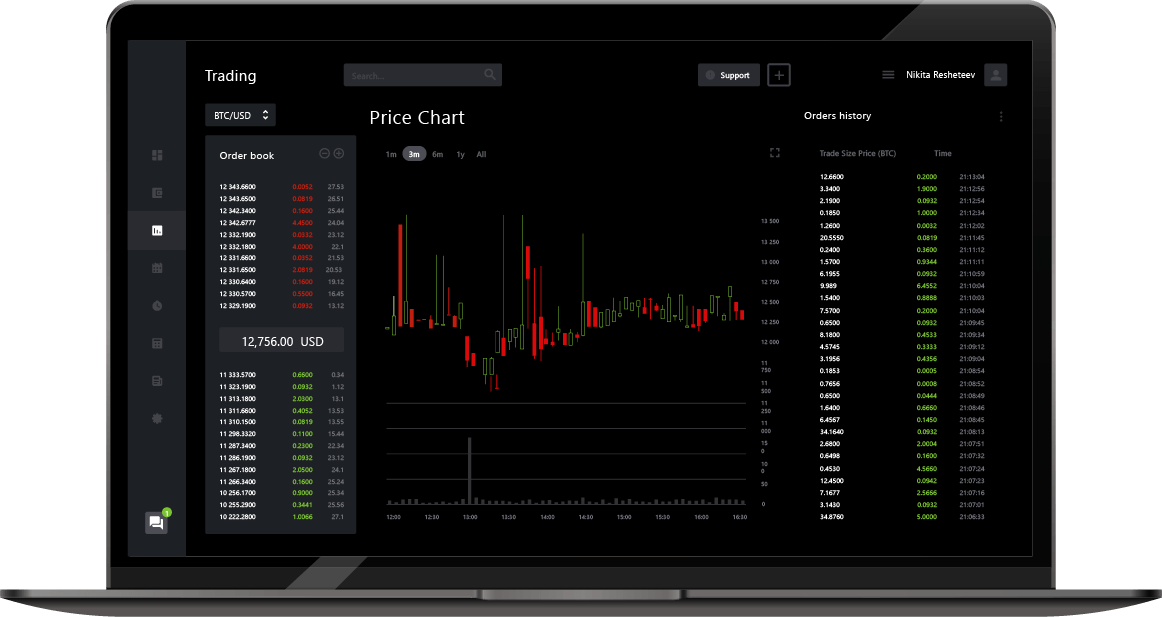

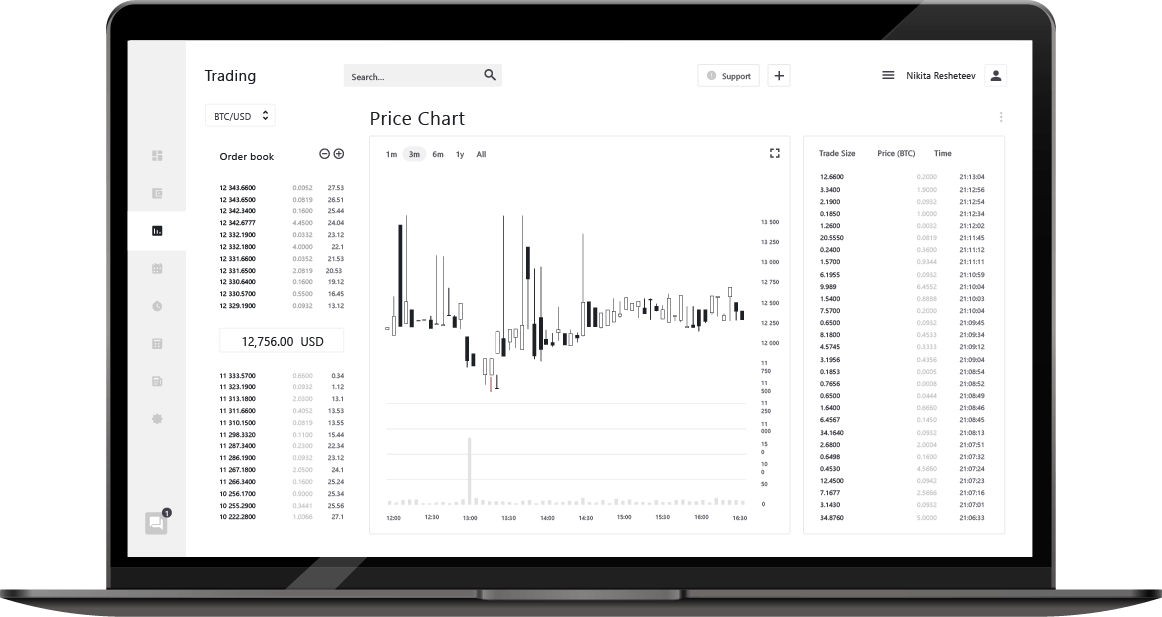

Superbly powerful trading platform

Credibit24 Webtrader

• Market sentiment & technical tools

• Instant trading via Buy and Sell buttons

• Stop loss and take profit functions

• Web-based and mobile compatible

Advanced features

• Advanced interactive charts

• Live data tables for any asset

• 9 charts timeframe (Seconds-Years)

• History data center up to 6 months

• 24/5 technical support

• Different languages available