SCALPING TRADING STRATEGY

Scalping is mostly used after crucial financial data are released such as the U.S.

employment report and interest rate announcements.

Overview

Forex scalping refers to forex traders who buy or sell a currency pair and then hold it for a short period of time to make a profit. A scalper seems to open many positions and make the most of the small price movements which happen randomly during the day. It seems like the profit is low per trade, like 5 to 20 pips, but if you increase the position size, you will see magnificent results.

Scalpers usually keep positions open for seconds to minutes and open and close multiple positions through a single day.

Forex Scalpers usually use leverage, which multiplies their power in the market allowing them to open larger sized positions, so a small change in price equals a considerable profit. For example, a five-pip profit in the EUR/USD on a $10,000 position (mini lot) is $5, while on a $100,000 position (standard lot) that five pip movement equates to $50.

Forex scalpers can trade manually or automatically. A manual experience means that the trader needs to sit in front of the computer, checking the signals continuously and decide to buy or sell. The automated system is a software which makes the buying or selling action automatically, for some input parameters.

Scalping is mostly used after crucial financial data are released such as the U.S. employment report and interest rate announcements. This happens because these data bring immediate impact on price fluctuations in a short period of time. Due to the increased volatility, position sizes may be scaled down to reduce risk. While a trader may attempt to usually make 10 pips on a trade, in the aftermath of a major news announcement they may be able to capture 20 pips or more, for example.

A scalper does not try to trade with large moves or high volumes. They try to take the best out of the small moves that occur frequently and trade with smaller volumes more often. Since the amount of trading is small, scalpers look for more liquid markets to increase the frequency of their trades.

Trade with us, safe and secure

Negative Balance

Protection

Trade with the most specialized

trading technology in the market.

Segregated

Accounts

Client capital is kept in separate accounts. The company is not able to use your funds for any reason.

Extra Security for

Big Funding

Additional risk management tools and standards to protect your capital up to $ 1 Million.

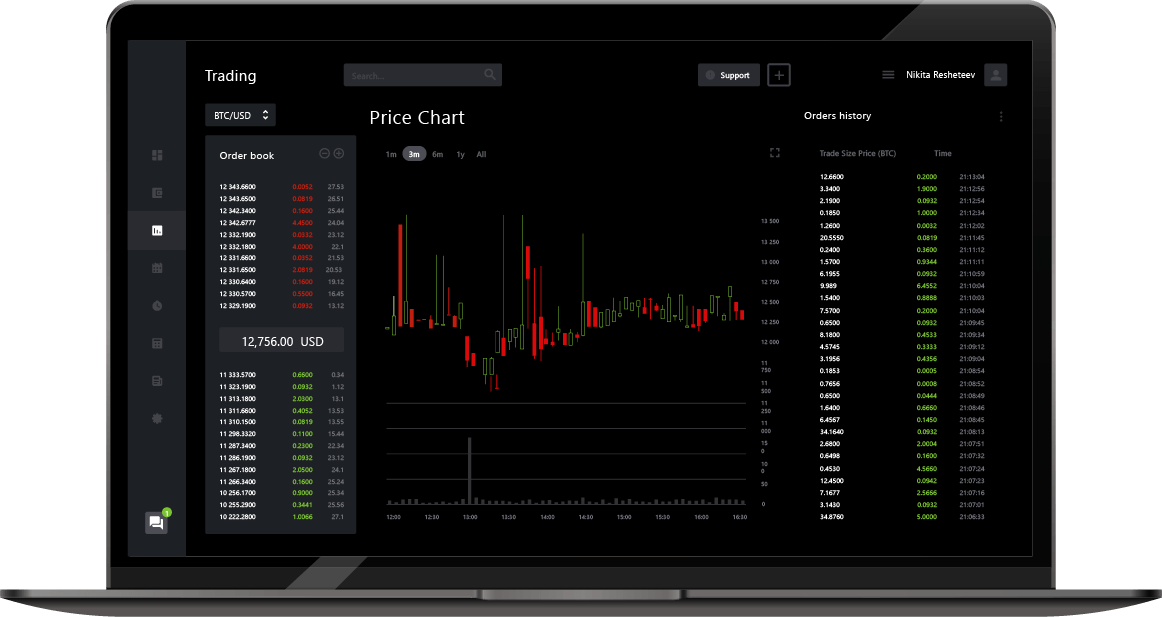

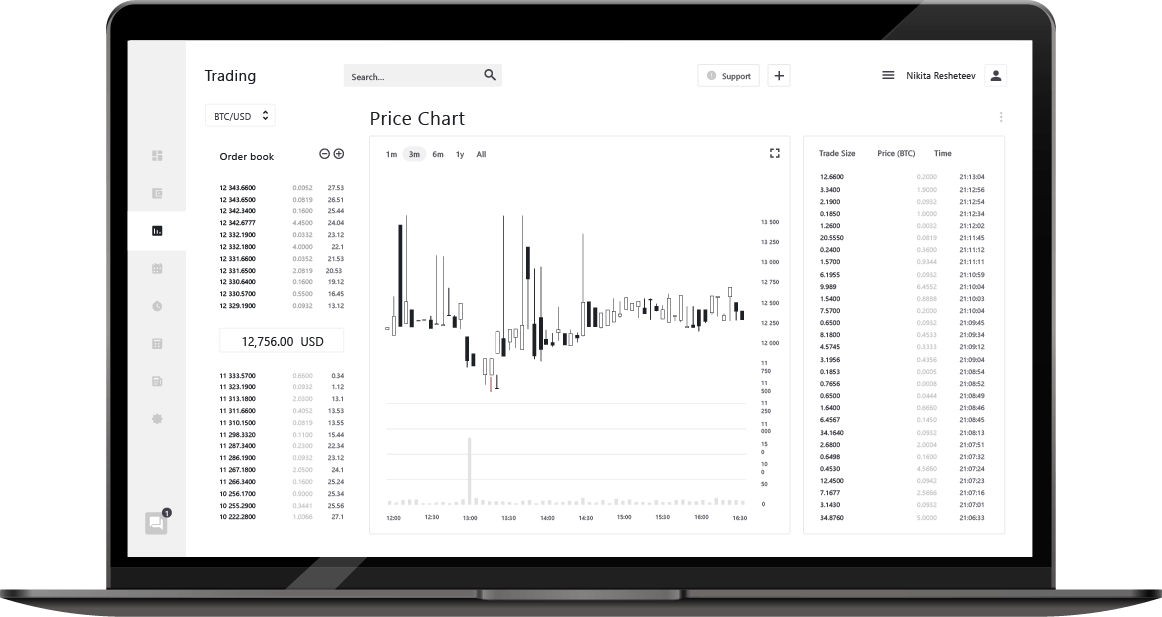

Superbly powerful trading platform

Credibit24 Webtrader

• Market sentiment & technical tools

• Instant trading via Buy and Sell buttons

• Stop loss and take profit functions

• Web-based and mobile compatible

Advanced features

• Advanced interactive charts

• Live data tables for any asset

• 9 charts timeframe (Seconds-Years)

• History data center up to 6 months

• 24/5 technical support

• Different languages available