SWING TRADING STRATEGY

Scalping is a very quick strategy applied by active traders.

It works by making the buying at the bid price and selling at the ask price.

Overview

Swing trading is the style of keeping positions open and catching movements in a stock or any financial instruments during a few days to several weeks. Their first “gun” to reach the necessary information is technical analysis. They check for opportunities through graphs. They may use fundamental analysis in addition to analyzing price trends and patterns.

The goal of swing trading is to capture a potential price move. Some traders go after volatile markets with sharp movements, others prefer safe stocks. In either case, swing trading is the process of identifying where an asset’s price is likely to move next, entering a position, and then capturing a chunk of the profit from that move.

Successful swing traders are only looking to capture a chunk of the expected price move, and then move on to the next opportunity.

Advantages

Asks for less time to trade compared to other styles;

Makes the most of short-term price movements by capturing the bulk of market; swings

Traders can rely only on technical analysis, making the trading process easier.

Disadvantages

Trade positions are exposed to overnight and weekend market risk;

Sudden market reversals can lead to considerable losses;

Longer-term trends are often lost in favor of short-term market moves.

Swings trades typically get in the game when a trend breaks. At the end of a trend, there is usually some price volatility as the new trend tries to establish itself. The main goal of swing trading is to spot a trend and then capitalize on the swing lows as periods of buying, and the swing highs as periods of selling. Swing traders often search for markets with a high degree of volatility as these are the markets in which swings are most likely to happen.

Trade with us, safe and secure

Negative Balance

Protection

Trade with the most specialized

trading technology in the market.

Segregated

Accounts

Client capital is kept in separate accounts. The company is not able to use your funds for any reason.

Extra Security for

Big Funding

Additional risk management tools and standards to protect your capital up to $ 1 Million.

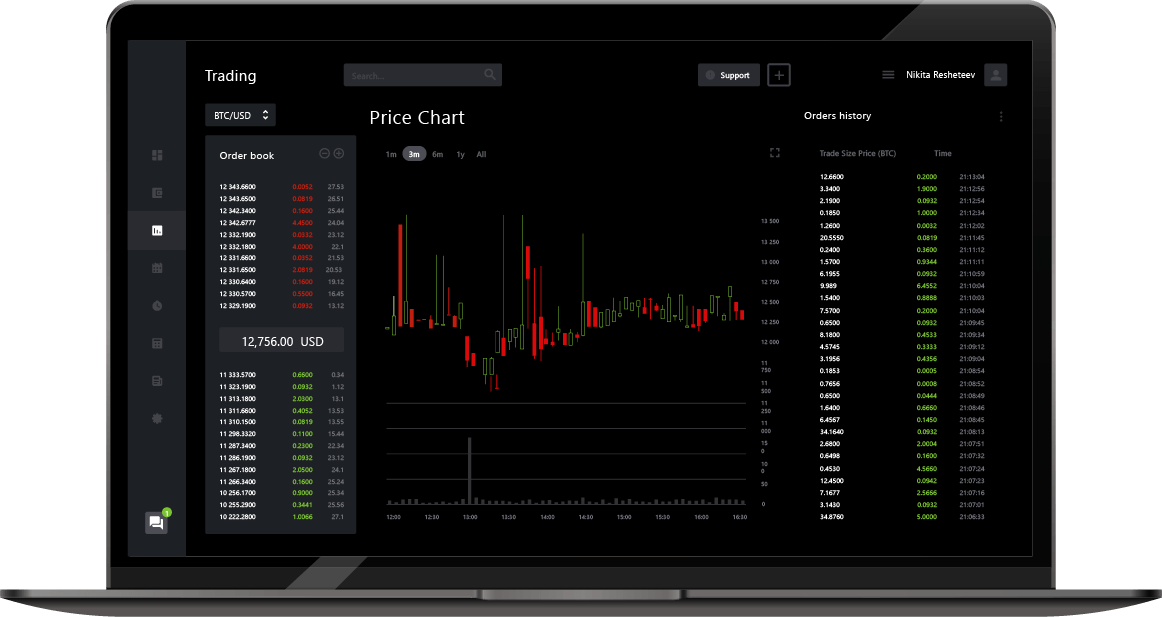

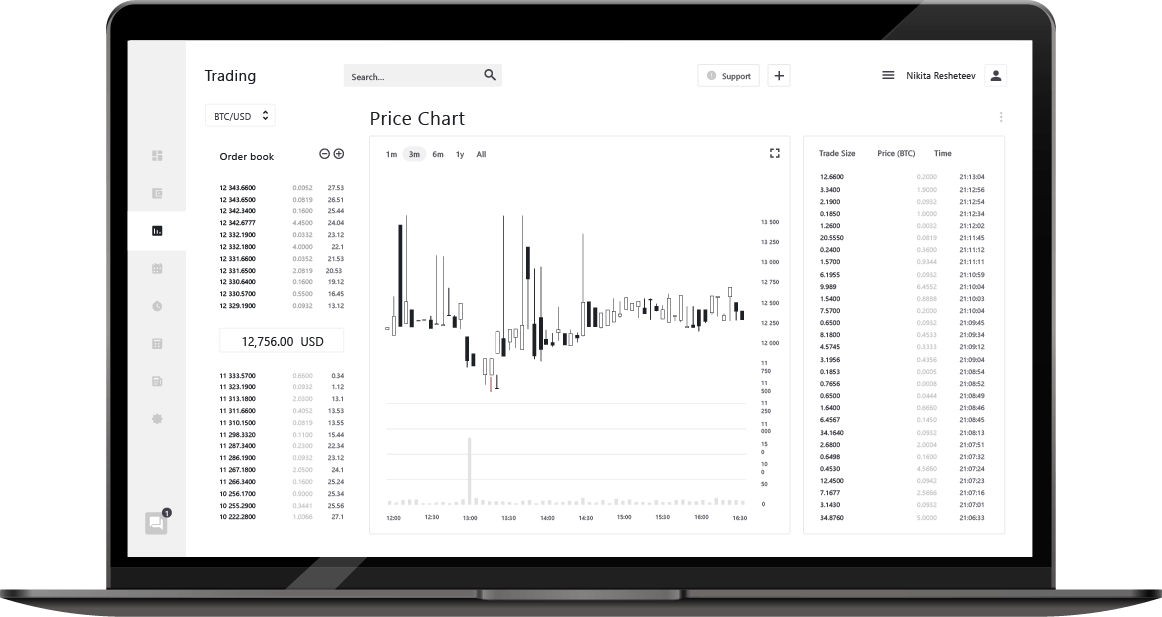

Superbly powerful trading platform

Credibit24 Webtrader

• Market sentiment & technical tools

• Instant trading via Buy and Sell buttons

• Stop loss and take profit functions

• Web-based and mobile compatible

Advanced features

• Advanced interactive charts

• Live data tables for any asset

• 9 charts timeframe (Seconds-Years)

• History data center up to 6 months

• 24/5 technical support

• Different languages available