SENTIMENT ANALYSIS

Sentiment analysis shows how market participants react towards the risk. When traders are feeling to go ahead in the market by the idea that the price movements will be in the same direction with what they have predicted, they usually make big moves on capital investments.

Overview

Since gains and losses are a consequence of traders interpretation of economic data and signals, counting on crowd psychology is also an essential tool in online trading. This is where sentiment analysis comes in.

Sentiment analysis consists of how markets are standing in front of the risk. When traders are willing to take risk, they will probably go after appealing instruments since they may feel secure of having higher returns. On the other hand, traders are not feeling like they want to take risks, they may put their money in safe-haven assets like US Dollar or Gold.

Price action in a way or another should reflect all available market information. But it is not as simple. Financial market will not reflect all of the information out there just because traders will all act the same way. So, things don’t work this way.

This is where sentiment analysis comes in light. Traders have their opinions of why the market is going how it is going, and if they want to trade in the same direction or against it. Trader’s thoughts and opinions are expressed through the action they take, so it is formed by the overall sentiment of the market regardless of what information is going around.

Sentiment analysis shows how market participants react towards the risk. When traders are feeling to go ahead in the market by the idea that the price movements will be in the same direction with what they have predicted, they usually make big moves on capital investments and they choose significant assets, since they are feeling confident about their actions. On the other hand, if they feel panic over the market, they will invest their money in safe-haven assets and in small amounts of money.

Aside from that, knowing if the risk is at the door or not, you need to figure out how traders are behaving towards certain news, reports or sudden economic events. When risk appetite is strong, assets may have a stronger reaction to take the most out of the report insight that confirms what they were thinking about. When risk aversion is in play, traders seem to have a stronger negative reaction to weak data which reinforce their bias while being less impressed by upbeat reports.

What tools can help you understand and use market sentiment? A smart choice would be checking on the stocks market and indices market, since they are considered as riskier assets, so they are able to better mirror the risk appetite of the traders. Falling stocks may reflect risk aversion, meanwhile rallying stocks may indicate high risk appetite.

Trade with us, safe and secure

Negative Balance

Protection

Trade with the most specialized

trading technology in the market.

Segregated

Accounts

Client capital is kept in separate accounts. The company is not able to use your funds for any reason.

Extra Security for

Big Funding

Additional risk management tools and standards to protect your capital up to $ 1 Million.

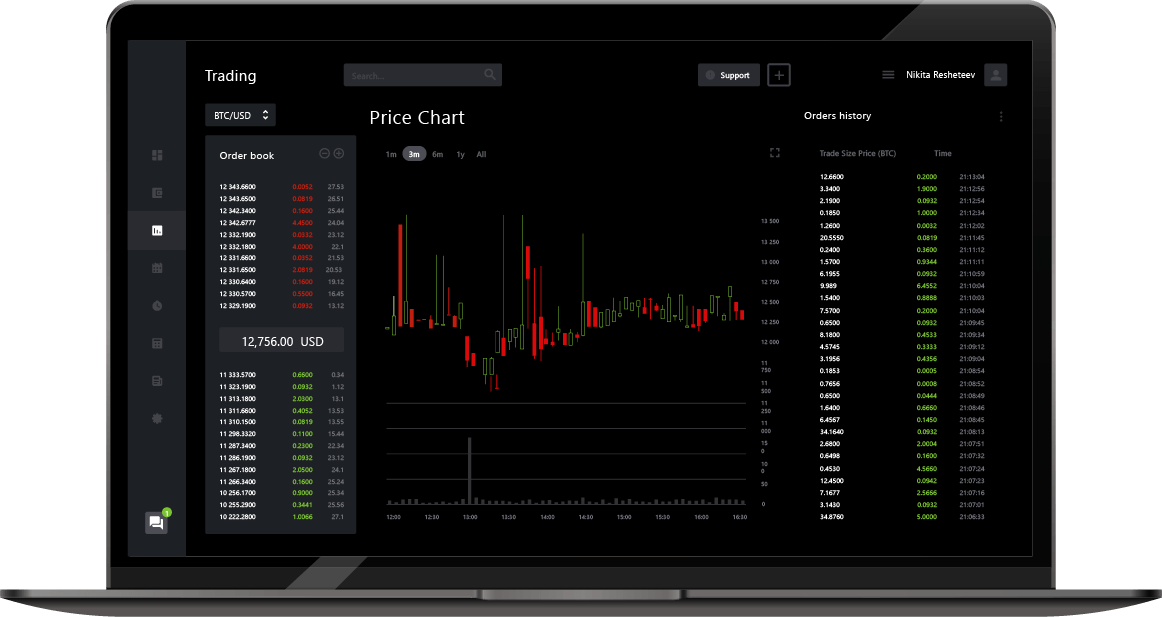

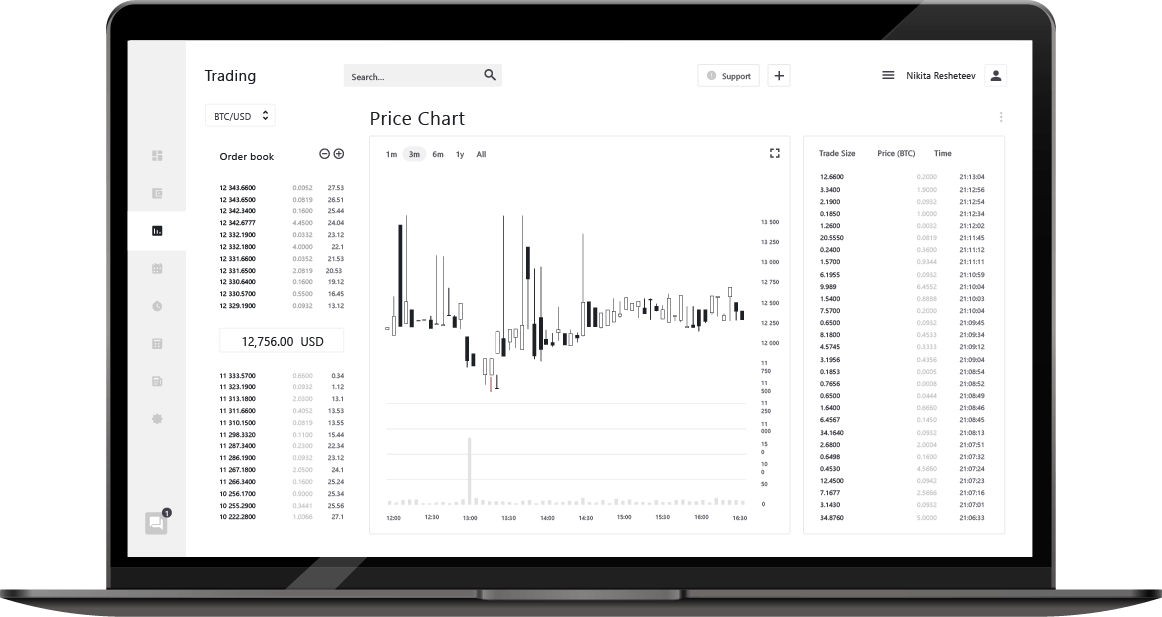

Superbly powerful trading platform

Credibit24 Webtrader

• Market sentiment & technical tools

• Instant trading via Buy and Sell buttons

• Stop loss and take profit functions

• Web-based and mobile compatible

Advanced features

• Advanced interactive charts

• Live data tables for any asset

• 9 charts timeframe (Seconds-Years)

• History data center up to 6 months

• 24/5 technical support

• Different languages available