TRADING PLAN

A plan describes what to trade, why, when, and how to do it.

It is a guideline that guides traders through the entire trading experience.

Overview

Creating a trading plan in advance and sticking to it is fundamentally an important action before exposing your capital to the market. In a few words, a plan describes what to do, why, when, and how to do it.

Not working with a plan is one of the reasons traders fail. An optimal trading plan should describe your major goals, what markets and specific assets to trade, how to keep records to review your historical actions and the results of your actions and how to control risk by the risk management plan.

A good plan should have answers for all of below: 1. How to manage trades;

2. What techniques or methods to employ;

3. What rules to use for entry and exit;

4. What pre and post-market activities to perform;

5. What checklists to use;

6. How to educate yourself;

7. How to act in case of a calamity.

Understanding a trading plan

Your trading plan should have as many details as possible. Even when it comes to trader’s emotions control and keeping the focus alive, your plan should have advice, solution and certain strategy. Of course, we are not telling you that there is one fixed plan which will work the best for all of you, you can tailor it as you want, depending on your trading personality. Plan your trade and trade your plan!

Skill Assessment

Trading the markets is a battle of give and take. The real pros are prepared and take profits from the rest of the crowd who, lacking a plan, generally give money away after costly mistakes.

Mental Preparation

Many traders have a market mantra they repeat before the day begins to get them ready. Create one that puts you in the trading zone. Additionally, your trading area should be free of distractions.

Set Risk Level and Goals

What portion of your portfolio should you risk on one trade? This depends on your trading style and tolerance for risk. Before you enter a trade, set realistic profit targets and risk/reward ratios. What is the minimum risk/reward you will accept?

Do Your Homework and trade preparation

Before the market opens, you should check what is going on around the world? Are the biggest markets up or down? What are the economic or earnings data that are due out and when? Post a list on the wall in front of you and decide whether you want to trade ahead of an important report.

Set Enter and Exit Rules

Before you enter a trade, you should know your exits. There are at least two possible exits for every trade. First, what is your stop loss if the trade goes against you? It must be written down. Mental stops don’t count. Second, each trade should have a profit target.

Keep Excellent Records and measure your performance

Many experienced and successful traders are always keeping records. If they win a trade, they want to know exactly why and how. More importantly, they want to know the same when they lose, so they don’t repeat unnecessary mistakes. After each trading day, adding up the profit or loss is secondary to knowing the why and how.

How to create a plan

-

Step 1 -

Choose Your Analytical Approach

The analytical approach raises the answer, “How do you find out trade tendency?”. It is usually found by a combination of price support and resistance, trend lines, chart patterns, Fibonacci levels, moving averages, Ichimoku Clouds, Elliott Wave Theory, sentiment or the use of fundamentals etc. This first step helps traders to focus on a handful of scenarios that the trader finds familiar. Even though the trader has a plan, he can look for opportunities to trade depending on trends of assets.

-

Step 2 -

Select Your Favourite Trade Setups

The trade set up stands in the center of the trading journey. Let’s first think of the analytical approach as a fundamental step towards trading. For example, viewing a consolidation pattern which can guide the trader to further actions, like going ahead to open more positions, close the current positions or just wait.

-

Step 3 -

Limit the Markets to Focus on

When starting, it is more effective for traders to limit the numbers of instruments in focus. Markets are not the same and do not have the same behaviour towards an event or a factor which might bring changes in its price. When you are focused in one market you better understand the nuances of it. Traders can even give special attention to specific time frames on a single market to familiarize themselves with what makes this market different from the others.

-

Step 4 -

Think About Your Holding Period

Time frames are related to the type of trader you choose or want to be. So, scalpers or day traders will focus more on short term trades since they open and close their positions on the same day. Swing traders will keep their positions open for a few hours up to a few days. Long term trading involves time frames from days, weeks, months and sometimes years.

-

Step 5 -

Know Your Risk Tolerance

All steps of the plan are important, but there is one, which if missed, is able to destroy the whole plan. Risk management should necessarily be part of the plan and taken in high consideration. Here, traders are encouraged to decide their personal risk tolerance by setting limitations of losses through stop loss mechanisms and taking profits.

-

Step 6 -

Plan How You Will Handle Adversity (and Success)

It is normal to experience setbacks, so it is crucial for traders to set a few rules so you will be able to manage emotions you would go through. A very smart way to achieve that is by quantifying an amount, or percentage loss that would force the trader to go one step back and evaluate what went wrong. This should be quantified in advance and not let take action in the moment the difficult situation arrives.

-

Step 7 -

Have a Routine For Staying on Track

It’s a smart move to review the trading plan and make changes if necessary. Periodical trade review and journaling are excellent ways to ensure you are following the process outlined in the trading plan. Make a note or save charts relating to successful/unsuccessful trade setups that can be reviewed later on.

Trade with us, safe and secure

Negative Balance

Protection

Trade with the most specialized

trading technology in the market.

Segregated

Accounts

Client capital is kept in separate accounts. The company is not able to use your funds for any reason.

Extra Security for

Big Funding

Additional risk management tools and standards to protect your capital up to $ 1 Million.

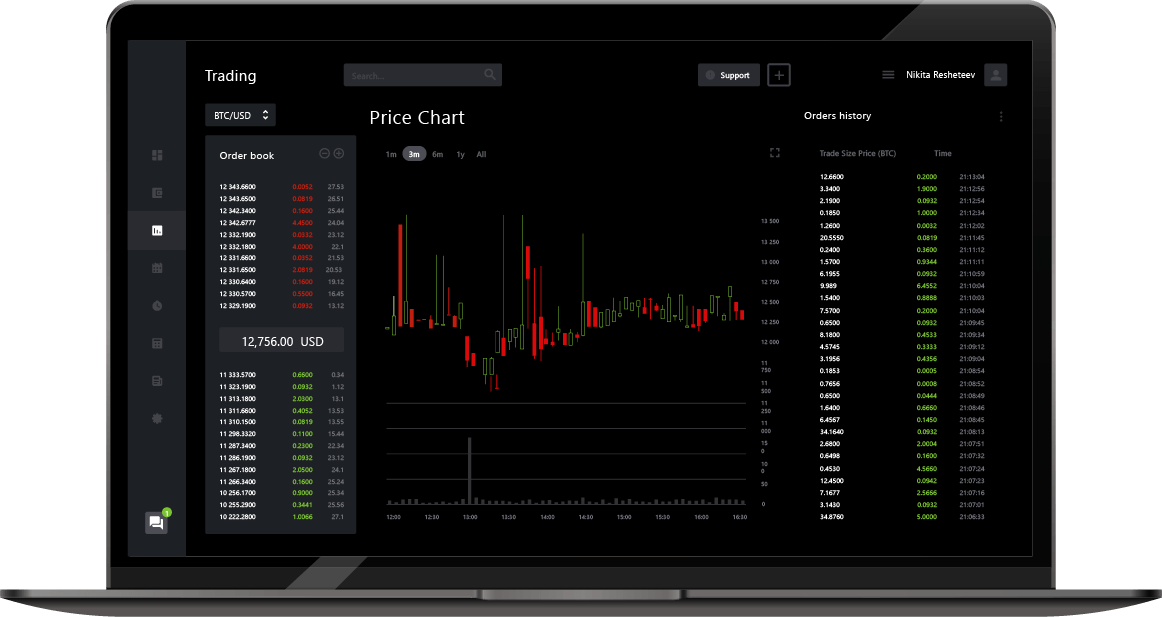

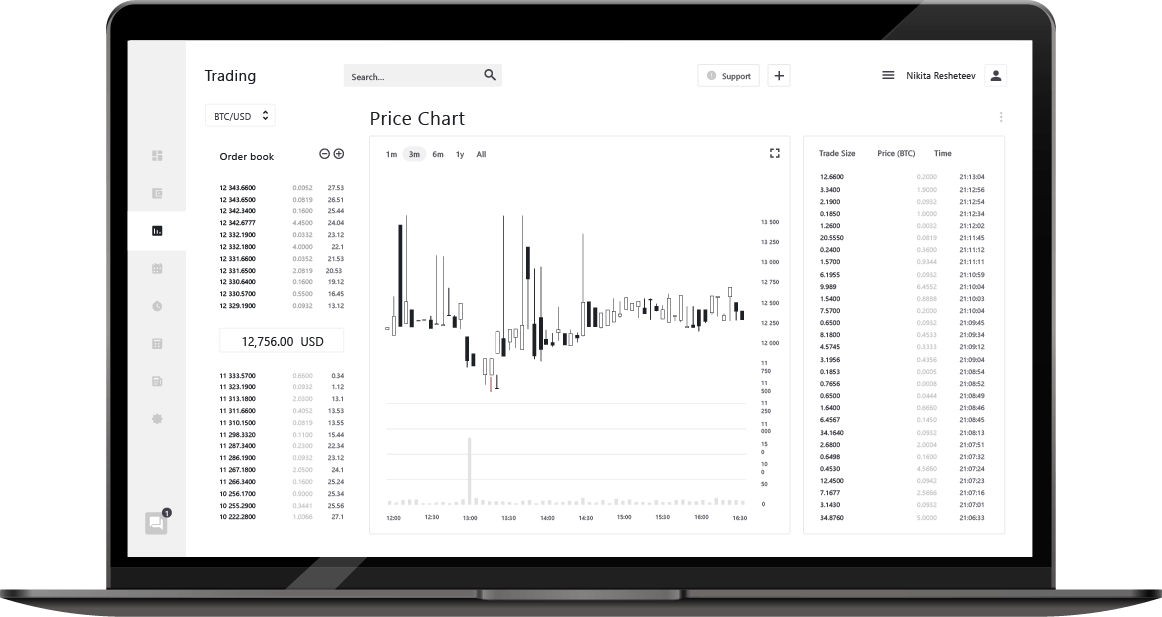

Superbly powerful trading platform

Credibit24 Webtrader

• Market sentiment & technical tools

• Instant trading via Buy and Sell buttons

• Stop loss and take profit functions

• Web-based and mobile compatible

Advanced features

• Advanced interactive charts

• Live data tables for any asset

• 9 charts timeframe (Seconds-Years)

• History data center up to 6 months

• 24/5 technical support

• Different languages available