SHARES & INDICES TRADING

Stocks are considered as an intelligent path to build wealth without the need to spend time on studying and going deep in the logic of financial markets or how the company works specifically.

Overview

Stocks or shares show a part of ownership of a company. They are issued to interested parties who are called shareholders. Shareholders receive part of the company’s profits in proportion with the number of shares they have under their name. When the company comes public, anyone is allowed to buy or trade stocks of the company. The only difference is that a trader doesn’t have the right to vote.

Trading stocks has been a popular way to invest capital and grow wealth. Once the companies come public, anyone is allowed to trade its stocks. Trading gives that outstanding opportunity of making profits by speculating on the direction of the price. There is no need to be the owner of the stocks, trade on the price. More traders preferring a stock, the more their value will grow with the time, the more the company and the traders will profit.

You can start trading stocks by just opening a trading account with Credibit24. It takes three steps to have your account activated. Open trades and manage them with the advanced features of our platforms. Use without doubts stop loss and take profit features to protect your capital. Put some limits when the trades will be closed automatically, and your capital will be safe.

Trading indices is like trading a whole market at once. An index is composed of many huge companies of the same sector, which will expose your capital to larger opportunities. Even if some of the companies are not doing good, the others will have their back and you will still be profitable.

The most famous indices are: The FTSE 100, UK’s 100 largest companies by market capitalization; Dow Jones, US’ 30 biggest companies; The DAX, 30 German biggest companies; NASDAQ 100, 100 largest tech companies in the US; Nikkei 225, Japan’s 225 biggest price-weighted index; CAC 40, France’s 40 biggest companies by capitalization.

Comparisons

- What are the three best stocks to trade?

There are best categories to trade like tech, pharmaceutical and energy renewing.

- Is trading stocks more risky than trading other assets?

Trading stocks is challenging, asks for knowledge but it is not more risky compared to other assets.

- Should I trade just one stock, or many of them?

It is always recommended to have a diversified trading portfolio, with multiple stocks.

- When Do Stock Prices Go Up or Down?

Stock prices are influenced by supply and demand, company inside issues like management and the launch of new products, media, social and political events and even opinions of the most famous investors.

- How much money do I need before you start to trade stocks?

The minimum to start is $ 250. But you can start with the amount that you want to.

- What factors influence indices rates?

The biggest factors are political events, employment figures and big changes in the currencies markets.

- What are the most famous indexes?

The most famous indices are: the FTSE 100, Dow Jones, the DAX, NASDAQ 100, Nikkei 225, CAC 40.

- How much should I invest to start trading Indices?

The minimum to start is $ 250. But you can start with the amount that you want to.

- Why are indices considered economic performance measures?

Indices are a composition of many companies of the same industry. They represent a part of the economy, so they are a key performance measurement of it.

- What are stocks?

In simple words, stocks are a good way to build wealth. When you buy a share of a company, you are the owner of this piece of the company. If you choose trading stocks, there is no need to buy the stock, you will only speculate on the future price of the stock.

- What are the most popular stocks of the moment?

The most famous and profitable assets of the moment are Dexcom (DXCM), Five9 (FIVN), West Pharmaceutical Services (WST), Teladoc Health (TDOC) and Wingstop (WING). These companies are moving stock exchanges because of their nature. Technology and the pharmaceutical industry are playing a crucial role in transforming people’s lives.

- How many stocks should I trade?

When you decide to trade stocks, it is good to diversify your portfolio, so you raise your chances to maximize your profits and minimize the risk. If you are trading one million dollar in your trading account, pick the maximum 5 or 6 stocks. Under $ 100k pick one or two.

- What is the role of ‘stop loss’, ‘take profits’?

A stop-loss order is created to limit the trader’s loss on a certain position. It is set manually on the trading platform and it is executed automatically once the condition is met. A take-profit order is created to maximize the traders profits on an open position, in other words the asset will be automatically sold once the conditional price is met.

- What are candlestick charts?

Candlesticks are a style of charts used to study the price movements of an instrument. Each candlestick presents one day, the opening price, the closing price, the maximum and the minimum price. One month candlestick chart will show 20 trading days (20 candlesticks).

Live Prices

An exceptional customer service support

Negative Balance

Protection

Trade with the most specialized

trading technology in the market.

Segregated

Accounts

Client capital is kept in separate accounts. The company is not able to use your funds for any reason.

Extra Security for

Big Funding

Additional risk management tools and standards to protect your capital up to $ 1 Million.

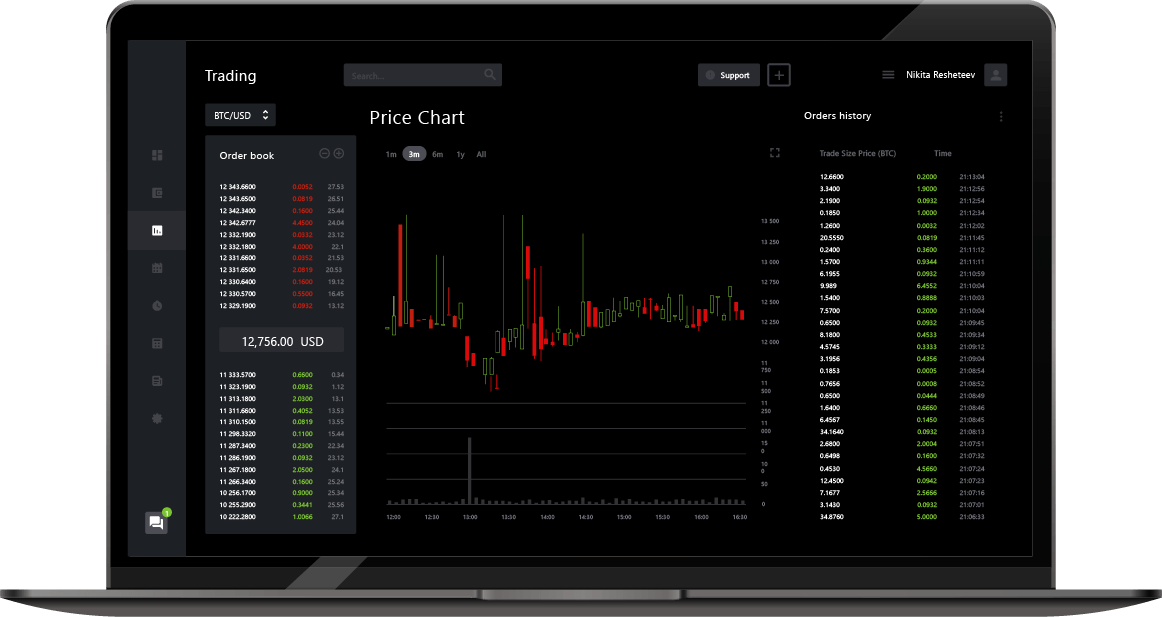

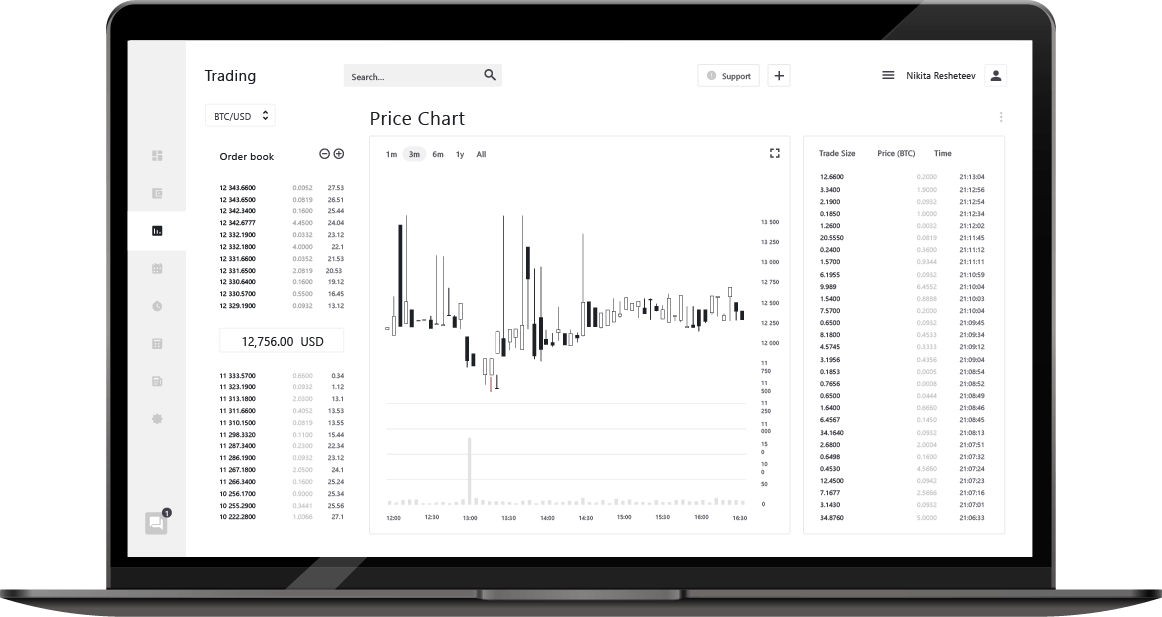

Superbly powerful trading platform

Credibit24 Webtrader

• Market sentiment & technical tools

• Instant trading via Buy and Sell buttons

• Stop loss and take profit functions

• Web-based and mobile compatible

Advanced features

• Advanced interactive charts

• Live data tables for any asset

• 9 charts timeframe (Seconds-Years)

• History data center up to 6 months

• 24/5 technical support

• Different languages available