FUNDAMENTAL ANALYSIS

Fundamental analysis aims to forecast the price movement of any tradable asset that is subject

to forces of supply and demand, based on the latest news and financial events.

Overview

Fundamental analysis is the technique of predicting the future price of an asset which an investor wants to trade. It is related to the examination of the worth of a company to evaluate if the current price of the market is fair or not, it means understanding if it is overpriced or underpriced. It is believed that taking into consideration the economy, strategy, product, financial situation and other related factors will mirror the market and provide consistent gains to the investors. It is necessary to analyse the forces that affect the interest of the overall economy, industrial sectors and company. It tries to forecast the future movement of the asset prices using those signals from the economy, industry and company. It asks for an examination of the market from a wider perspective.

There is a crucial question in financial markets, how market participants forecast their future market progression. Financial market participants are often categorized related to two different forecasting approaches, Fundamentals and Technical. Stock analysis is vital when deciding to invest and when evaluating investment strategies.

Regular market analysis can ensure to make the most out of your investment, meanwhile minimize the risk. Some investors prefer fundamental analysis while others prefer technical one.

Quantitative and Qualitative Fundamental Analysis:

The point with defining the word fundamentals is that it can cover anything which has to do with the economic well-being of a company. They include numbers like revenues and profit, but they include things like a company’s market share to the quality of its management.

The fundamental factors can be grouped into two categories: quantitative and qualitative. By definition these terms mean:

Quantitative – capable of being measured or expressed in numerical terms.

Qualitative – related to or based on the quality or character of something, often as opposed to its size or quantity.

As you can understand, quantitative fundamentals are numbers.They are measurable characteristics of a business. This is the reason why the main source of quantitative data is financial statements: revenue, profit, assets, and more can be measured with great precision.

The qualitative fundamentals are less tangible. They might include the quality of a company’s key executives, its brand-name recognition, patents, and proprietary technology.

Fundamental analysis is made up by 3 components:

Overall Economy analysis

Sector industry analysis

Individual Company analysis

Fundamental analysis is quite a complex approach that asks for very good knowledge of accounting, finance, and economics. To be clear, fundamental analysis requires the ability to understand and interpret the numbers of financial statements, understanding the macroeconomic factors and knowledge of valuation techniques. It based its logic on public data, as for example the public historical data over profits, margins and this way it is able to project the future growth.

Fundamental analysis is based on different data, issued for free from companies and governments for the public. They include corporate earnings reports, geopolitical events, central bank policy, environmental factors. There are many factors which influence these reports and eventually the markets.

Inflation

Inflation is the level at which the prices for goods and services raise. Central banks try to limit the raising rates, in order to keep the economy running safely. They try to do so by hiking the interest rates. When a rate hike is announced, the respective currency is appreciated.

Unemployment

Information from labour markets is presented by non-farm payrolls, which has usually high influence in indices and forex markets. It is released on the first Friday of every month. It shows the total number of paid US workers of any business. Let’s say for example that the non-farm payroll is increasing, this is usually interpreted as the economy is getting stronger and people tend to raise their investing levels.

GDP

Gross Domestic Product is a measure of all goods and services produced yearly. Traders and investors look at GDP growth to know if the economy is getting stronger or weaker. When the economy is getting stronger, companies generate higher profits and people generate more money, which eventually lead to a rise in the stock market and a stronger currency.

Trade with us, safe and secure

Negative Balance

Protection

Trade with the most specialized

trading technology in the market.

Segregated

Accounts

Client capital is kept in separate accounts. The company is not able to use your funds for any reason.

Extra Security for

Big Funding

Additional risk management tools and standards to protect your capital up to $ 1 Million.

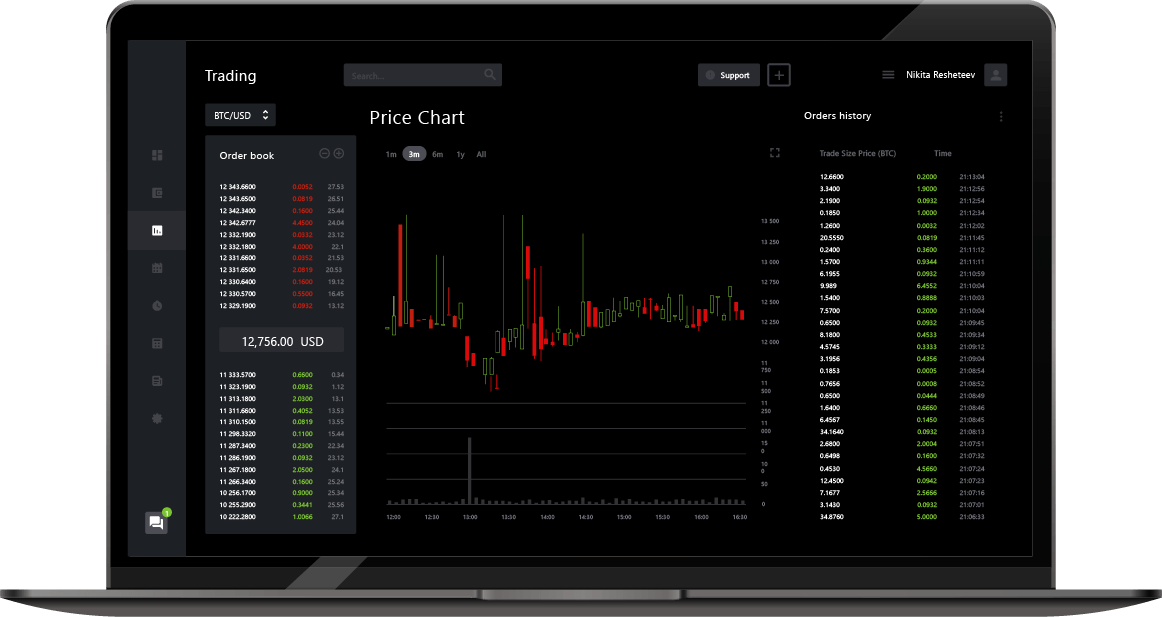

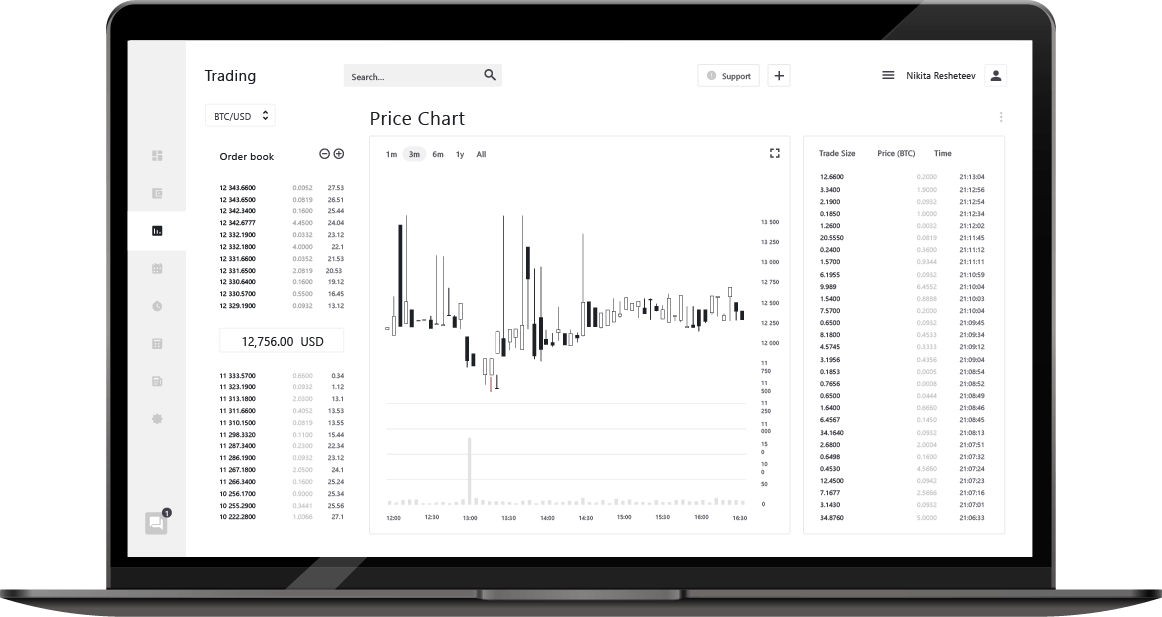

Superbly powerful trading platform

Credibit24 Webtrader

• Market sentiment & technical tools

• Instant trading via Buy and Sell buttons

• Stop loss and take profit functions

• Web-based and mobile compatible

Advanced features

• Advanced interactive charts

• Live data tables for any asset

• 9 charts timeframe (Seconds-Years)

• History data center up to 6 months

• 24/5 technical support

• Different languages available